Blackrocks’ entry into the real-world assets (RWAs) market with a $100 million deposit on Ethereum has arguably made RWAs the hottest topic in crypto. Blackrock and other major players have started to move into this space because traditional real-world assets, like real estate, bonds, and art, often suffer from limited liquidity, inefficient processes, and a lack of transparency.

RWAs powered by Web3 technologies offer a solution. Etherland prioritizes secure data management, streamlined workflows, and reliable historical records. This core focus lays the groundwork for diverse RWA applications across industries. Etherland aims to reshape the way businesses and markets interact with real-world assets, unlocking greater efficiency and accessibility through blockchain solutions.

Defining Real-World Assets in Web3

RWAs encompass a broad range of tangible assets linked to the physical world. Within Web3, this involves representing ownership or rights relating to an asset through digital tokens on a blockchain. This technology transforms how we interact with everything from real estate and precious metals to fine art and collectible items.

Blockchain technology offers solutions to challenges such as illiquidity, which plagues assets like commercial buildings that are difficult to buy or sell quickly. Additionally, complex ownership structures or fragmented records can create barriers to assets like artwork. Tokenization on the blockchain introduces exciting possibilities for increased efficiency, streamlined transactions, and enhanced transparency across various asset classes.

It’s important to note that RWAs extend beyond simply dividing an asset into smaller, tradable tokens (fractionalization). They can represent a diverse array of rights or claims linked to real-world objects, enabling a wide range of use cases like efficient trading, more accessible fundraising models, and even tracking the environmental impact of supply chains.

The Transformative Power of Blockchain RWA Solutions

RWAs have the potential to reshape how we interact with and utilize real-world assets. Here’s why:

- Enhanced Liquidity: Traditionally illiquid assets, such as large commercial real estate holdings, can be represented as tokens. This allows them to be traded much more easily, opening up new investment opportunities and improving market efficiency. A great example of this is the tokenization of US treasury bills, which exceeds $1 billion as of April 2024.

- Global Accessibility: Blockchain-based RWAs transcend geographical borders. This enables global marketplaces where assets can be traded 24/7, potentially increasing the pool of potential investors and lowering transaction costs.

- Transparency: The blockchain provides an immutable and tamper-proof ledger of all transactions and ownership history. This creates greater trust and reduces the risk of fraud or disputes about an asset’s past.

The potential of RWAs reaches far beyond simply making assets easier to buy and sell. This technology has applications within diverse industries. Real estate fundraising platforms, supply chain optimization through tracking physical assets, and even the secure exchange of sensitive medical data are all possibilities within the RWA landscape. Etherland’s data-driven approach positions it to play a vital role in this evolution.

Etherland’s RWA Approach: Beyond Fractionalization

Etherland distinguishes itself within the RWA landscape by focusing on the fundamental challenges that plague traditional asset management. Rather than solely concentrating on tokenization for investment purposes, Etherland’s primary focus lies in building a robust data foundation to enable meaningful RWA implementations.

The ProApp: Secure Workflows, Reliable Data

The ProApp provides a secure platform where sensitive documents related to real estate transactions can be stored with advanced encryption. Workflows are streamlined through smart contracts and collaboration tools, reducing bottlenecks and potential errors. This focus on security and efficiency addresses pain points common across various real-world asset use cases.

Estatepedia: RWAs for Cultural Preservation

Estatepedia offers an innovative application of RWA concepts. It securely links images, historical records, and additional data to digital representations of landmark sites. This tamper-proof ledger preserves vital information and creates a potential for community engagement and fundraising to support historical landmarks. This unique approach highlights the potential versatility of RWA technology.

RWA Innovation: The Tecra Space Campaign

Etherland is actively developing its RWA solutions, and the launch of its fundraising campaign on the Tecra Space platform is the next step in the team’s plans to become a leading RWA crypto project. This initiative aims to secure resources for developing and expanding B2B and B2C RWA tools. The Tecra Space campaign empowers investors to join Etherland’s mission and fuel the advancement of real-world solutions on the blockchain.

Etherland’s RWA Solutions and the ELAND Token

The ELAND token plays a pivotal role within Etherland’s ecosystem. It serves as the primary means of facilitating transactions across the platform’s RWA solutions. Additionally, Etherland will leverage ELAND to incentivize the submission of reliable and accurate data.

This community-driven approach fosters high-quality data, which is crucial for the success of many RWA applications. In the future, ELAND will offer users staking features and see its role expand within Etherland’s numerous RWA-based NFT collections.

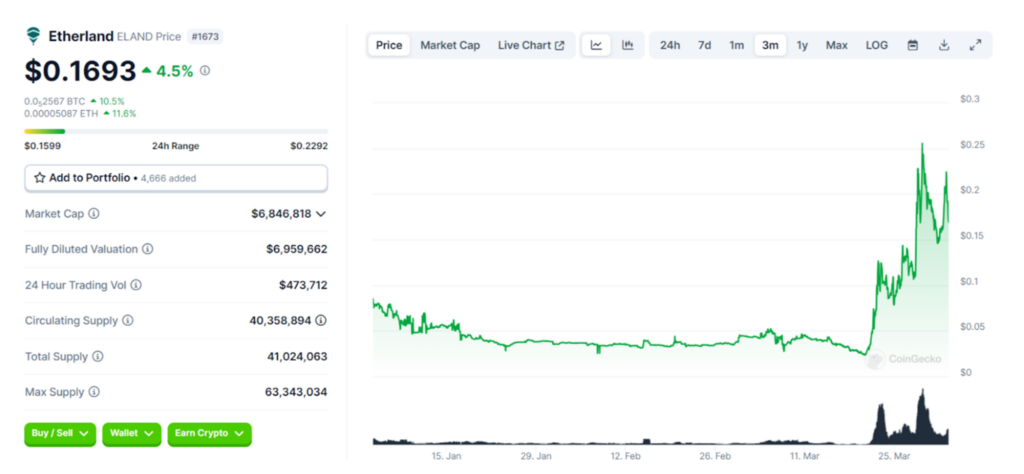

ELAND has been one of the best-performing cryptocurrencies in the RWA category over the past six months. The market has recognized the project’s potential, and massive inflows, primarily on the Uniswap and PancakeSwap, have driven a 700% increase in ELAND’s price from $0.025 to over $0.16 as of writing in early April.

Despite the surge in ELAND’s price, its market capitalization is still under $10 million, which means that relatively small buy orders have the potential to drive the price considerably higher. Furthermore, other projects in the RWA sector have hefty valuations, some well over $100 million, which, while reflecting the potential of this sector, also means that many tokens would require massive inflows to achieve price apprications comparable that of ELAND over the past few months.

Etherland’s Vision for the Future of RWAs

The Tecra Space campaign has been launched to fuel the development of innovative RWA solutions designed to reshape how businesses interact with real-world assets. This initiative accelerates the creation of more efficient, accessible, and transparent markets across sectors.

Etherland believes that secure and verifiable data form the bedrock of successful RWA implementation. With a focus on robust data management solutions, Etherland aims to unlock the full potential of blockchain technology for real-world applications.

From streamlining complex real estate transactions to enabling new forms of asset-backed financing, Etherland envisions a future where RWAs transform industries and unlock new global opportunities for individuals and businesses.

Learn more about Etherland and the RWAs by joining the community on Telegram, Discord, and X.