First steps

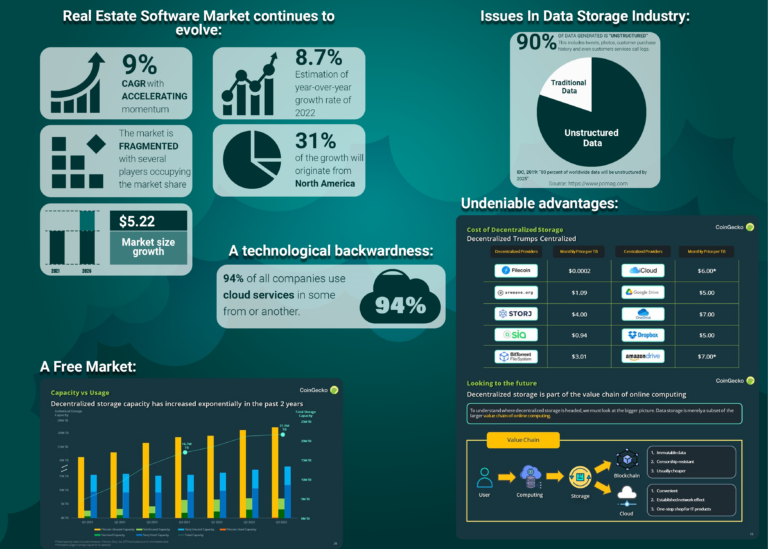

We had our eyes on the global stage from the very beginning. We analysed our target sector and its existing technology, and compiled everything Etherland could bring to the table – regardless of timeframes.

We had our eyes on the global stage from the very beginning. We analysed our target sector and its existing technology, and compiled everything Etherland could bring to the table – regardless of timeframes.

The next step was to zoom in. We had to find our target segment.

We attended events, joined networks and made contacts in the industry.

This enabled us to engage with potential clients, from French state officials to smart-city actors and major realtors.

Once we identified which players benefited most from our solution, we adapted it to fit their needs and started pitching and closing partnerships.

Not only does our technology deeply interest all our prospected clients, but some are also willing to

collaborate on a Proof-Of-Concept.

For this reason, we need to finish building our infrastructure.

Thus, we need funds.

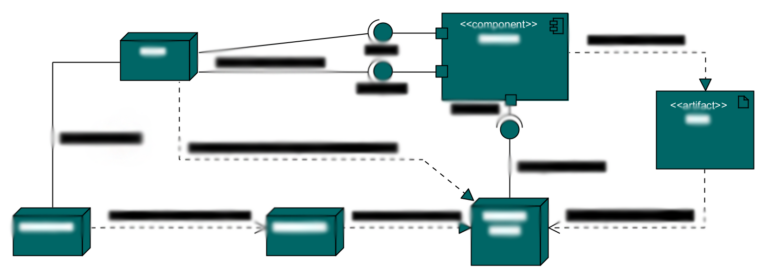

Our goal is for our company to own the technology and Etherland’s Intellectual Property. For each target commercial application sector we are planning to set up a dedicated company.

Such approach would allow us to develop our portfolio incrementally and 100% focus on R&D. At the moment, we are raising funds for the IP company. In the future, we will organise financing rounds for individual commercial applications.

At first, we considered crowdfunding to ensure we remain the sole owners and decision-makers for the Etherland brand and technology. But the timing was not ideal and would take too much time.

Hence, we are considering loans, subsidies, or co-development contracts with interested clients & partners. Get in touch!

IP Company Funds Distribution